The Cost Of Living In Australia 2025

Australia has long been considered a dream location to put down roots. Whether you’re looking to relocate your family, seek new career opportunities, or are ready for an outback adventure, there’s certainly a lot to offer in the land down under.

But, while Aussies are well known for their laid back, low-key lifestyle, the cost of living might be higher than you may realise.

From wages to tax rates, housing, utilities, education and more, in this article, we’re diving into everything you need to know about the cost of living in Australia in 2025.

What is the cost of living exactly?

Cost of living is determined using a number of different metrics including the price of essential products and services, general affordability, and how changes to these costs impact individuals and families from different parts of the country.

The Aussie government works out the cost of living via:

A note on cost of living metrics

While cost of living (COS) metrics are good indicators, the truth is, the results can vary greatly.

For this reason, COS should not be considered as a complete authority when it comes to the circumstances of an entire population.

With that said, exploring the cost of living and some of the variations you can expect, can help you understand more clearly how you may be affected personally, and the things you can do to keep costs down.

The year that was - 2024 ‘Cossie livs’

It’s no surprise that 2024 kept Aussies feeling the pinch as the ‘cozzie livs’ crisis rolled on. Housing affordability hit harder than ever, with property prices soaring in cities like Sydney and Melbourne, and interest rates staying high. In true Aussie fashion, the term ‘cozzie livs’ stuck around to sum up the struggle—paying more and getting less, while finding creative ways to adapt to an increasingly tough economy.

Key cost of living stats from 2024

So, what’s in store for 2025 and are there ways to keep costs down?

What is the average cost of living in Australia in 2024?

There is no exact figure for the cost of living in Australia. However, Expatistan estimates the current cost of living in Australia is roughly AU $5,105 per month for a single person or AU $8,801 per month for a family of four.

Based on these figures, the cost of living in Australia is ranked more expensive than 90% of countries in the world (6 out of 61)

The cost of living in Australia is ranked more expensive than in 87% of countries in the world.

Cost of living vs. standard of living

While cost of living describes the cost associated with core essentials such as food, housing, health care, utilities and transport, standard of living refers more to the quality or comfort of your life.

How much do you need to live comfortably in Australia?

Living comfortably in Australia varies greatly depending on factors such as location, lifestyle and personal preferences. As a general guide, a single person living outside of a major city would need an annual income of $70 - $80k per annum or $5,800+ per month. Of course this total increases for couples and families.

Key facts

What’s the average salary in Australia?

The median weekly earnings / salary for employees in Australia is $1,396 or $40 per hour.

This can be broken down further:

Average salary by State / Territory

Australian Capital Territory (ACT) has the highest median weekly earnings at $2,000 per week while South Australia has the lowest at $1,700 per week. Australian Bureau Statistics

Highest paying professions in Australia 2024

Career opportunities in Australia are diverse and can be highly financially rewarding. Some of the highest paying sectors include healthcare, finance, tech and mining and natural resources.

- Neurosurgeon: $604,582

- Anaesthetist: $405,000

- Internal Medicine Specialist $305,788

- Financial Dealers / Traders: $275,984

- Psychiatrist: $270,412

- Other Medical Practitioners: $222,933

- Judicial or Legal Professionals: $188,798

- Mining Engineer: $184,507

- Enterprise Architecture Manager: $168,762

- CEO or Managing Director: $164,896

Tax rates in Australia

The amount of tax you pay in Australia depends on how much you earn. Under the current rules, if you earn under $18,200 per year you won’t pay any tax.

However, if you have an income of $190,001 or more, you’ll pay $51,638 plus 45c for each $1 over $190,000. Below is a table detailing the income brackets and associated tax.

Find out more information on tax costs in Australia here.

| Taxable income | Tax on this income |

| 0 – $18,200 | Nil |

| $18,201 – $45,000 | 16c for each $1 over $18,200 |

| $45,001 – $135,000 | $4,288 plus 30c for each $1 over $45,000 |

| $135,001 – $190,000 | $31,288 plus 37c for each $1 over $135,000 |

| $190,001 and over | $51,638 plus 45c for each $1 over $190,000 |

Education costs in Australia

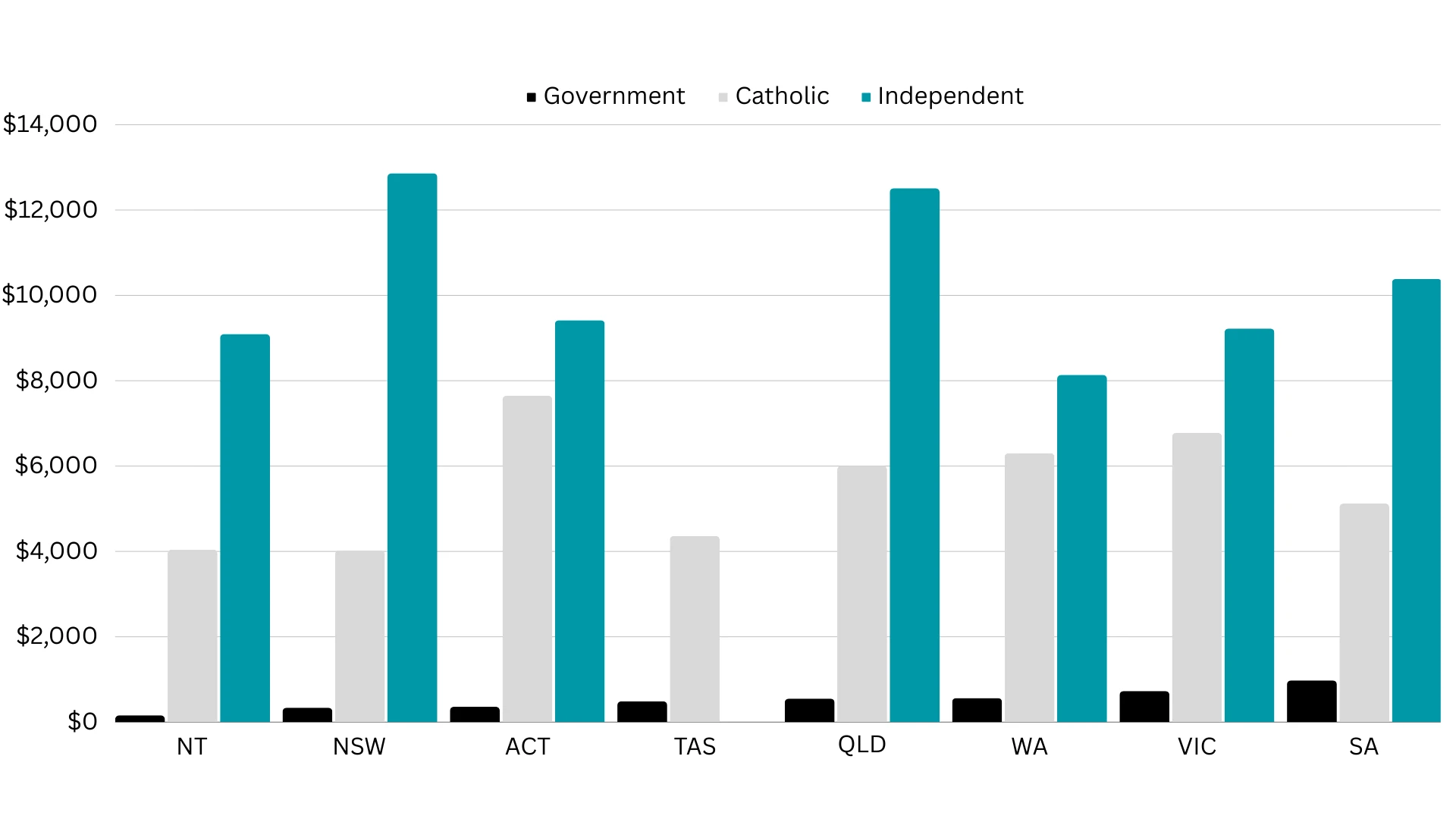

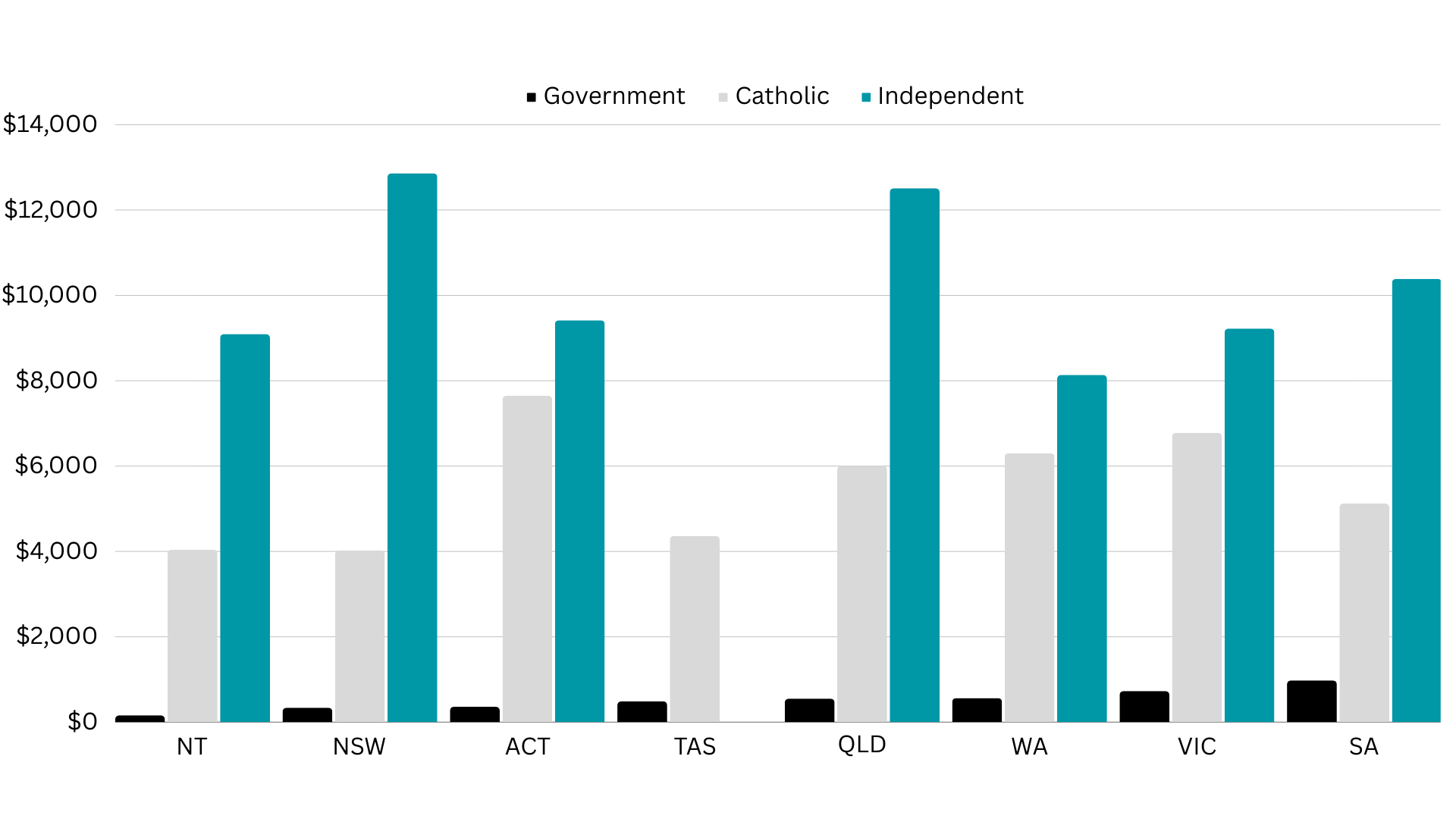

Average annual secondary school tuition

Primary and secondary school

Primary and secondary school

Tuition fees cost parents anywhere between $485 per year for public primary school to $13,896 per year for independent secondary schools.

Again, costs vary between States and Territories.

ACT holds the title as the most expensive state for private primary schools. The average school tuition cost here is $8,511 per student, per year.

New South Wales has the most expensive private secondary schools with an average annual tuition cost of $13,896. That's $3,500 more than the average cost in Victoria.

When it comes to government education, South Australia has the highest cost. Schools here ask for an average voluntary contribution of $485 per year for primary levels and $967 for secondary students.

ACT holds the title as most expensive state for private primary schools. The average school tuition cost here is $8,511 per student, per year.

University fees

Tuition fees and the cost of studying in Australia will vary depending on:

Lists the average costs as follows:

| Education Type | Average Tuition |

| English Language course | $300 per week |

| Vocational Education and Training | $4,000 - $22,000 per year |

| Foundation course | $15,000 -$39,000 total |

| Bachelor Degree | $20,000 - $45,000 per year |

| Master's Degree | $22,000 -$50,000 per year |

| Doctoral Degree | $20,000 -$42,000 per year |

| MBA | $11,000 -$121,000 per year |

Child Care

Child care can be expensive depending on where you live. The average daily cost for childcare across Australia is $135.29 but in some parts of the country, parents pay up to $430 per day.

Average daily childcare cost by location

While there are subsidies available for Aussie families, these are means tested and so the eligible amount (if any at all) will vary greatly from family to family.

Use this childcare cost calculator to discover the average cost of childcare in your area.

Housing and property prices 2024

According to CoreLogic Data, homeowners are now required to set aside 46.2% of their income in order to service their mortgage repayments. This is one of the biggest factors to consider when it comes to cost of living - particularly if you are entering the property market for the first time.

| Location | Median Property Value |

| Sydney | $1,053,131 |

| Melbourne | $797,477 |

| Brisbane | $720,000 |

| Adelaide | $650,000 |

| Perth | $560,000 |

| Darwin | $500,000 |

| Combined capitals | $820,000 |

| Combined regionals | $600,000 |

| National | $750,000 |

Cost of living by city

Sydney

Sydney is one of Australia’s more expensive cities to live in. With an average monthly salary of $6,833, basic utility costs of around $327.19 per month (for an 85m2 apartment), and rental costs of about $327.19 per month (on a 1 bedroom apartment) Sydney cost of living rates are significantly higher than other cities across Australia.

Brisbane

In Brisbane, the monthly costs for a family of four is estimated to be around $8,574 without rent while the average monthly costs for a single person is estimated at $5,110.

Brisbane is noted to be 15.2% less expensive than Sydney overall and rental prices are 31% cheaper.

Brisbane residents pay an average of $206.37 in utility bills each month(for an 85m2 apartment) and rental of a 1 bedroom apartment in the city centre is roughly $2,354.82 per month.

The average net salary in Brisbane is $5,964.25 per month.

Melbourne

In Melbourne, the average cost of living for a family of four is $5,756.50 per month without rent or $1,602.60 per month for a single person without rent.

Melbourne is rated 12.4% less expensive than Sydney (without rent) and rent is an average 29.1% lower than in Sydney.

Melbourne residents pay an average of $230.59 per month in utility bills for an 85m2 apartment and the cost of rent for a one bedroom CBD apartment is roughly $2,400 per month.

Adelaide

Overall Adelaide is considered to be about 20% less expensive than Sydney. Average monthly costs for a family of four are $5,808.90 without rent and $1,671.60 per month for a single person without rent.

Rent in Adelaide is on average 42.3% lower than in Sydney.

Basic utilities on an 85m2 apartment will set the average household back $272.49 per month and the average salary is $4,283.55

Canberra

Canberra's cost of living is 1.2% lower than Sydney's (without rent) despite rent prices being, on average, 36% lower.

A family of four can expect to pay up to $5,767.40 a month in expenses before considering rental or mortgage costs.

A single person's estimated monthly costs are $1,968.70 without rent.

Canberra is 1.2% lower than Sydney's (without rent) despite rent prices being, on average, 36% lower.

1.2% lower than Sydney's (without rent) despite rent prices being on average, 36% lower.

Perth

Perth is estimated to be about 14% less expensive to live in than Sydney. Monthly expenses for a family of four are roughly $5,513.50 without rent or $1,536.70 for a single person.

Rent in Perth is, on average, 32.7% lower than in Sydney.

Cost of fashion and entertainment

Sports, fashion and entertainment costs aren’t generally associated with cost of living. They are, however, costs that most people indulge in on a semi-regular basis.

Here are some of the average costs you might expect when it comes to fashion and entertainment.

| Sports, leisure activities & Shopping | Average Cost |

| Fitness Club, Monthly Fee for 1 Adult | $63 |

| Tennis Court Rent (1 Hour on Weekend) | $20 - $40 |

| Cinema, International Release, 1 Seat | $17.50 |

| 1 Pair of Jeans (Levis 501 Or Similar | $139.95 |

| 1 Summer Dress in a Chain Store (H&M) | $84.22 |

| 1 Pair of Nike Running Shoes (Mid-Range) | $177.82 |

| 1 Pair of Men Leather Business Shoes | $201.73 |

Moving to Australia

Wherever you’re planning to move to in Australia, it’s clear by now that the costs can certainly add up.

In saying that, one of the major draw cards of this country is the ability to take pleasure in the small things, and the things that cost little or nothing at all.

Beautiful beaches, national parks, sweeping hinterlands and a smorgasbord of free activities you can fill your new life with mean you can keep your spending and material possessions down to a minimum.

But, for those prized possessions you’re bringing with you when you do move, you’ll want to ensure you have removalists you can trust.

At Upmove, we help you find the best moving companies at the best price - so that’s one less cost you need to worry about.

What do our customers say?

Primary and secondary school

Primary and secondary school